Our Approach

You could also call this heading “Our philosophy” or “Our vision.” This is the place to talk about what drives you and your business and what’s unique about your process. What you write here should be something distinct and interesting about your business that sets it apart from others in the same industry.

Our Story

Every business has a beginning, and this is where you talk about yours. People want to know what opportunity you saw or how your passion led to the creation of something new. Talk about your roots–people wanna know you have some.

Meet the Team

Write something about the people who make your business go or your philosophy behind customer service. Why? Because people want to know who they’re doing business with. It’s a human thing.

Regan McCook

Founder & CEO

Include a short bio with an interesting fact about the person.

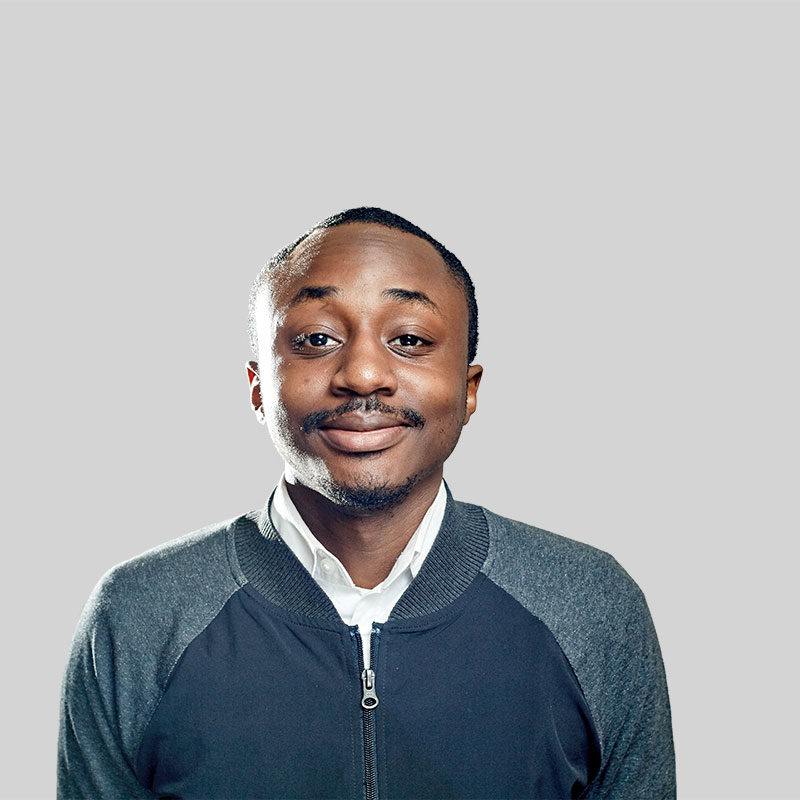

Eric Teagan

Vice President

Include a short bio with an interesting fact about the person.

Timothy Barrett

CFO

Include a short bio with an interesting fact about the person.

Next Steps…

This is should be a prospective customer’s number one call to action, e.g., requesting a quote or perusing your product catalog.